VoP Overview

Overview

The newly introduced Instant Payment regulation mandates that Account Servicing PSPs need to perform a Verification of the Payee for any credit transfer initiated by their payment service users. The EPC has edited a rulebook to organize a scheme called VoP, to standardize the needed interactions between the participants.

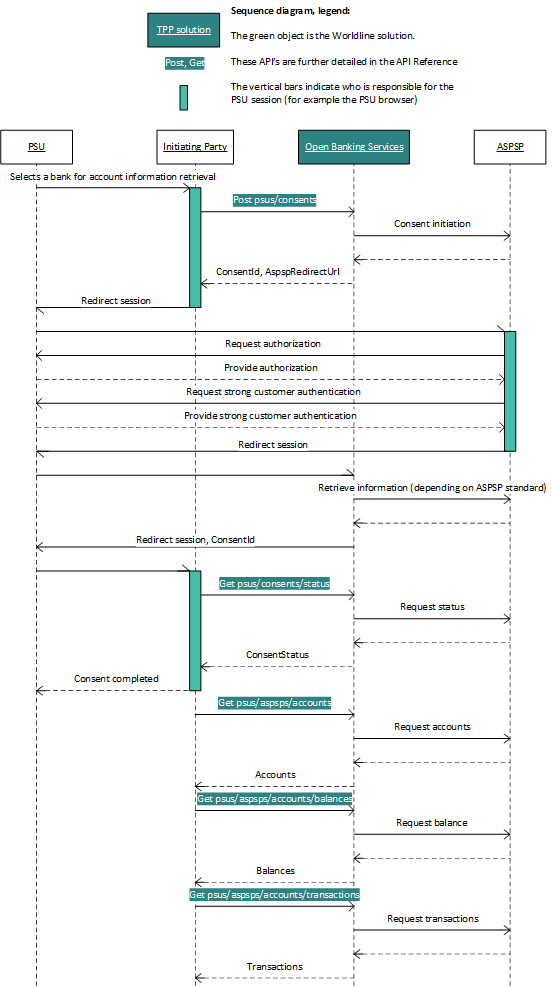

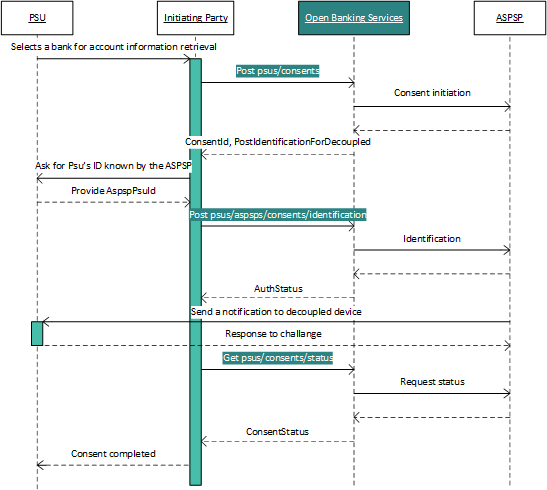

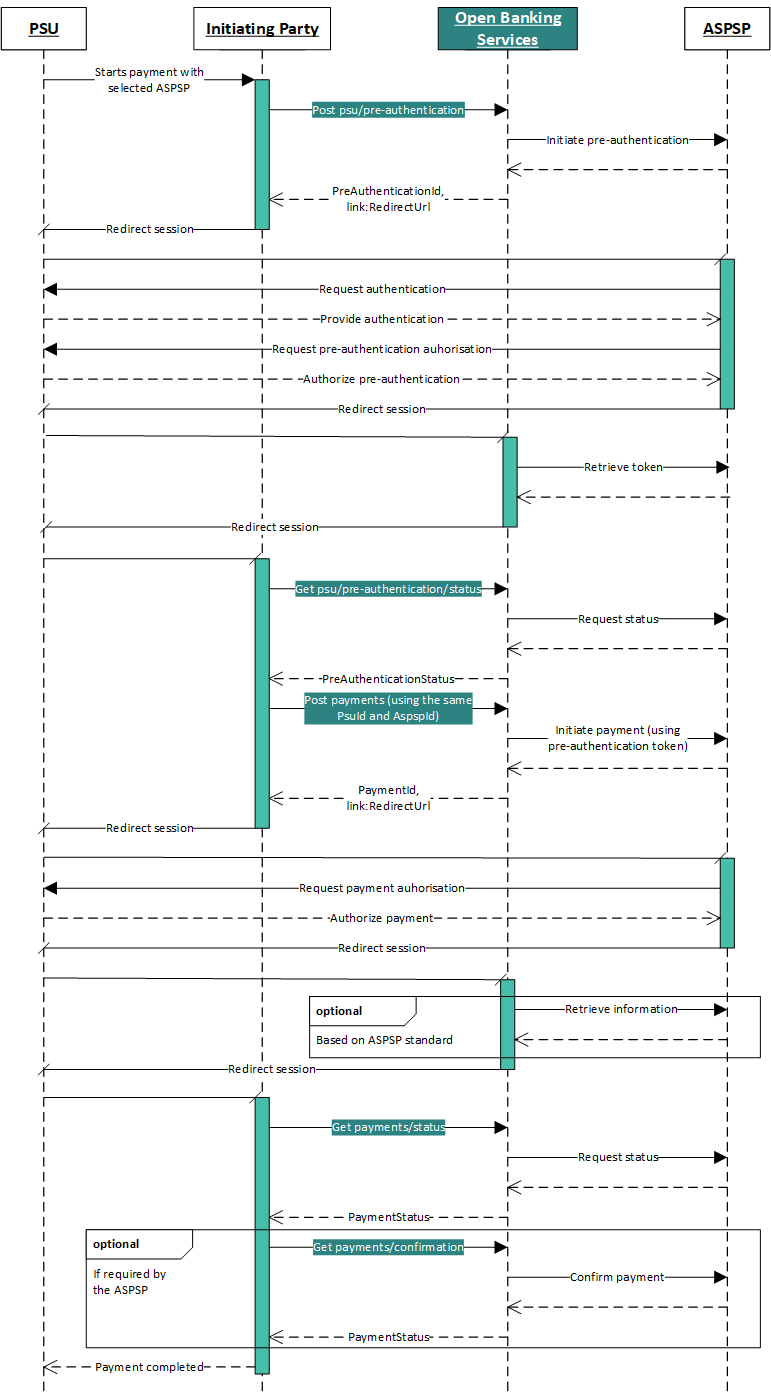

The diagram below shows a generic VoP processing flow and the different involved actors, as the rulebook defines it.

A glossary defining the scheme specific terms used below can be found at the bottom of this page.

Instant Payment Regulation & VoP compliance timeline

A final publication of the Worldline VoP APIs will be made available after the publication of the EPC rulebook first definitive version, in October 2024.

Verification of Payee by Worldline

Discover Verification of Payee by Worldline on our website !

The Worldline Verification of Payee services allow banks to comply with the new Instant Payment regulation and its Verification of Payee requirement, as requesting and responding PSP, and compliant participant of the EPC VoP scheme.

In this documentation you will find detailed information and draft specifications on how Worldline facilitates VoP processing in this context, letting PSPs fulfill both scheme roles, with the products highlighted in the diagram below :

Glossary

- EPC : European Payments Council

- VoP : Verification Of Payee, process of verifying the identity of a payer prior to a payment initiation via SEPA Credit Transfer, as mandated by the Instant Payment Regulation.

- IPR : Instant Payment Regulation

- RVM : Routing and verification mechanism. In the EPC VoP rulebook defined actors, an intermediate service provider for the requesting or responding PSP, acting on behalf of the PSP in the scheme.

- PSP : Payment Service Provider. In this context, an Account Servicing PSP (Bank).

- Requesting PSP : In the VoP ecosystem, the party (bank) performing a verification of Payee, for the Payer.

- Responding PSP : In the VoP ecosystem, the party (bank) responding to a request of verification of Payee.

- Requester : Payer / Payment Service User (PSU)

- Worldline VoP Hub : The SaaS offering of Worldline that will route VoP requests between the necessary systems and provide matching results in accordance with the EPC scheme rules.

- OIDC : OpenId Connect standard, based on Oauth2, used by the WL VoP Hub authentication service. See here and API specifications for more details.

- CRUD : Create, Read, Update, and Delete operations.