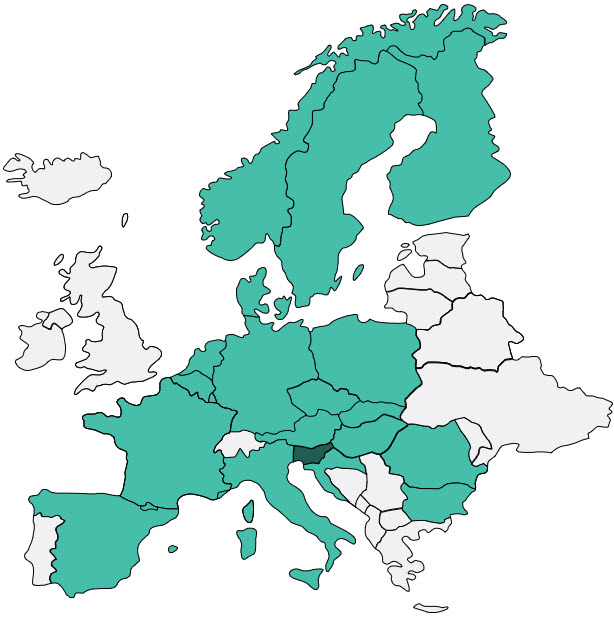

Slovakia

Slovakia

Enable "on this page" menu on doc section

On

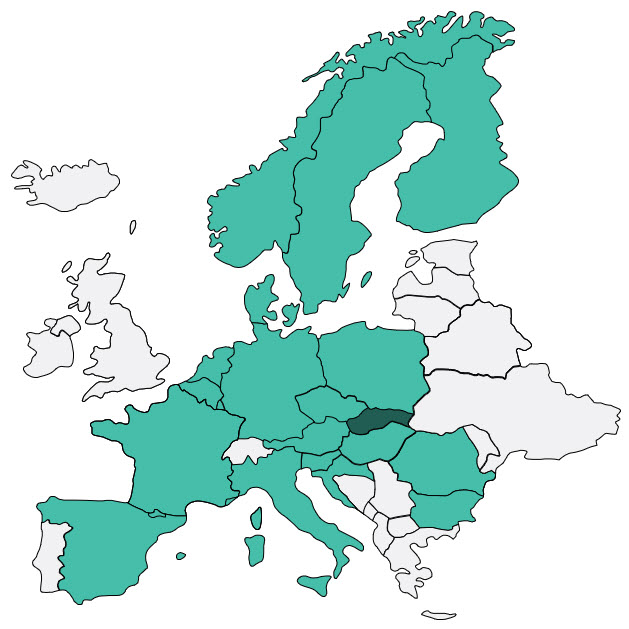

Romania

Romania

Enable "on this page" menu on doc section

On

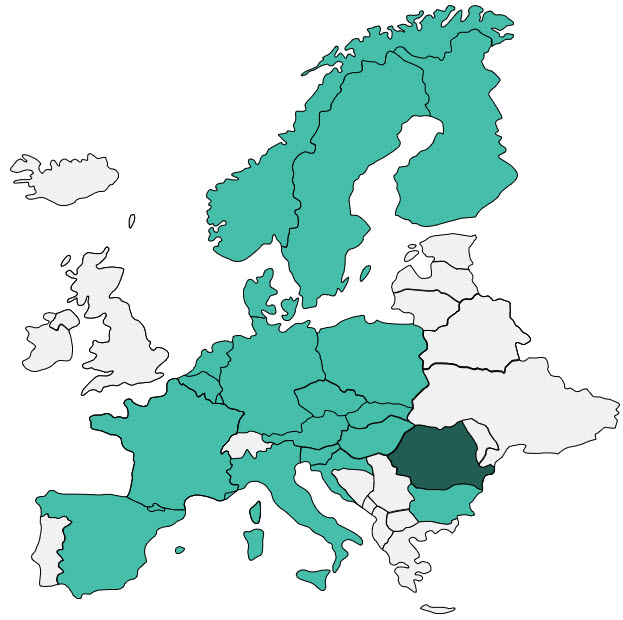

Poland

Poland

Enable "on this page" menu on doc section

On

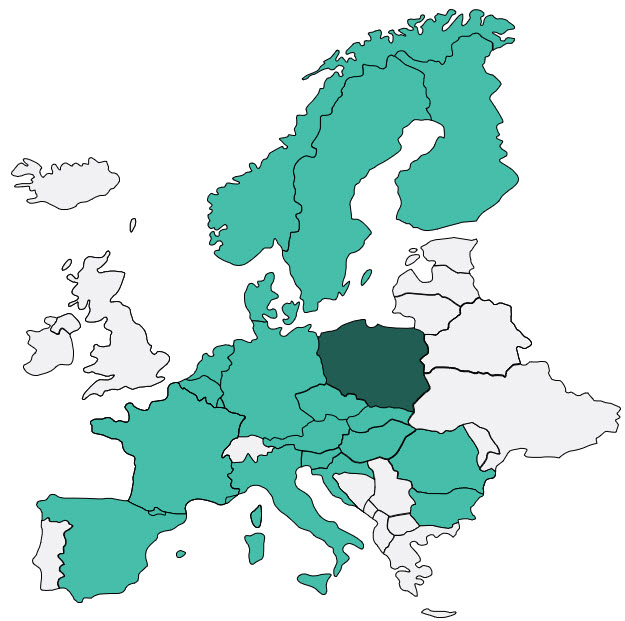

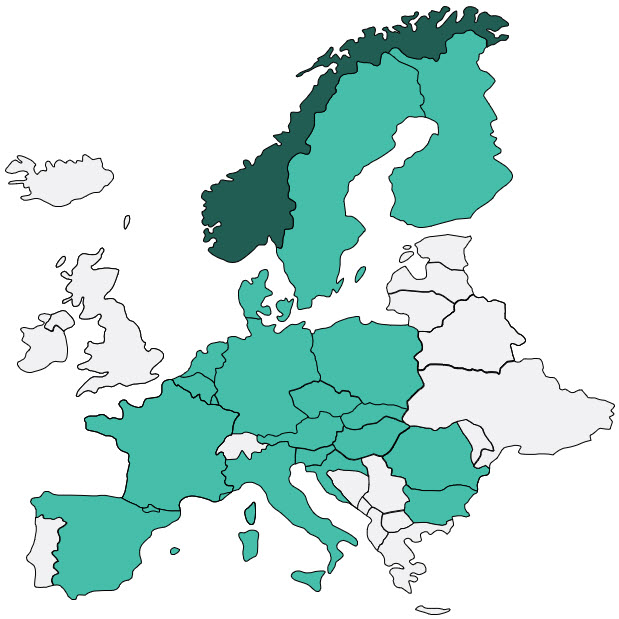

Norway

Norway

Here is the list of banks in Norway that you can initiate payments or

retrieve data from using our Open Banking products:

- Høland og Setskog Sparebank

- Hønefoss Sparebank

- Indre Sogn Sparebank

- Jæren Sparebank

- Jernbanepersonalets Bank og Forsikring

- KLP Banken

- Komplett Bank

- Kvinesdal Sparebank

- Landkreditt Bank

- Larvikbanken

- Lillesands Sparebank

- LillestrømBanken

- Luster Sparebank

- Maritime & Merchant Bank

- Marker Sparebank

- Melhus Sparebank

- MyBank ASA

- Næringsbanken: Currently, no website available.

- Nidaros Sparebank

- Nordea Bank Ab (Publ), Filial I Norge

- Nordea Direct Bank

- Nordic Corporate Bank

- OBOS-Banken AS

- Odal Sparebank

- Ofoten Sparebank

- Oppdalsbanken

- Orkla Sparebank

- Ørland Sparebank

- Ørskog Sparebank

- Oslofilialen Norsk Avdeling Av Utenlandsk Foretak: Currently, no website available.

- Østre Agder Sparebank

- Pareto Bank

- Rindal Sparebank

- Revolut

- RomsdalsBanken: Currently, no website available.

- RørosBanken

- Sandnes Sparebank

- Santander Consumer Bank

- Sbanken

- Selbu Sparebank

- Skagerrak Sparebank

- Skandinaviska Enskilda Banken Ab (SEB)

- Skudenes & Aakra Sparebank

- Skue Sparebank

- Søgne og Greipstad Sparebank

- Soknedal Sparebank

- SpareBank 1 BV

- SpareBank 1 Gudbrandsdal

- SpareBank 1 Hallingdal Valdres

- SpareBank 1 Lom og Skjåk

- SpareBank 1 Modum

- SpareBank 1 Nord-Norge

- SpareBank 1 Nordvest

- SpareBank 1 Østfold Akershus

- SpareBank 1 Østlandet

- SpareBank 1 Ringerike Hadeland

- SpareBank 1 SMN

- SpareBank 1 Søre Sunnmøre

- SpareBank 1 SR-Bank

- SpareBank 1 Telemark

- Sparebank 68° Nord

- Sparebanken DIN

- Sparebanken Møre

- Sparebanken Narvik

- Sparebanken Øst

- Sparebanken Sogn og Fjordane

- Sparebanken Sør

- Spareskillingsbanken

- Stadsbygd Sparebank

- Storebrand Bank

- Strømmen Sparebank

- Sunndal Sparebank

- Surnadal Sparebank

- Swedbank Norway

- Tinn Sparebank

- Tolga-Os Sparebank

- Totens Sparebank

- Trøgstad Sparebank

- Tysnes Sparebank

- Valdres Sparebank

- Valle Sparebank

- Vekselsbanken

- Vik Sparebank

- Voss Sparebank

Enable "on this page" menu on doc section

On

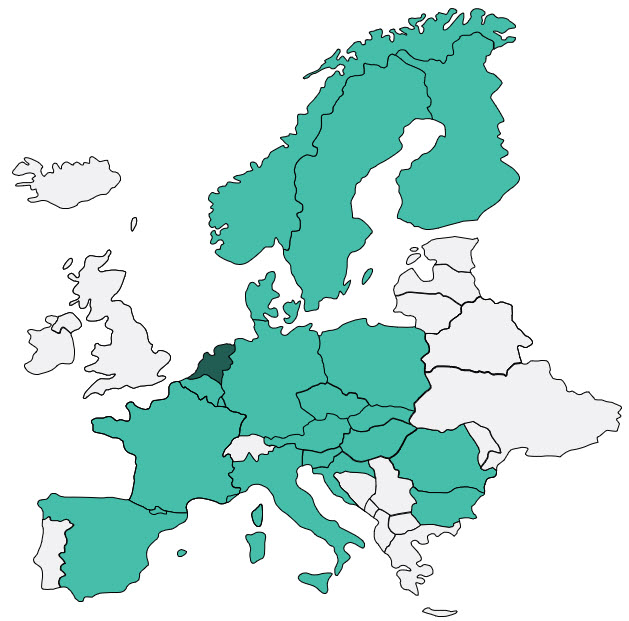

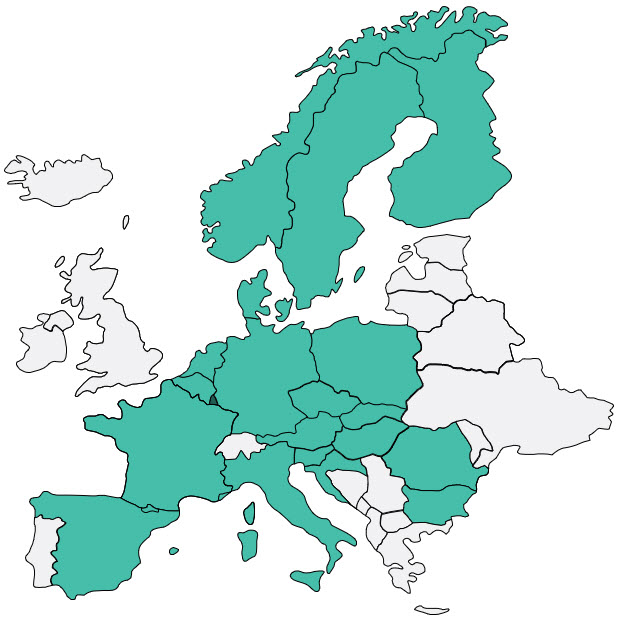

Netherlands

Netherlands

Enable "on this page" menu on doc section

On

Luxembourg

Luxembourg

Enable "on this page" menu on doc section

On

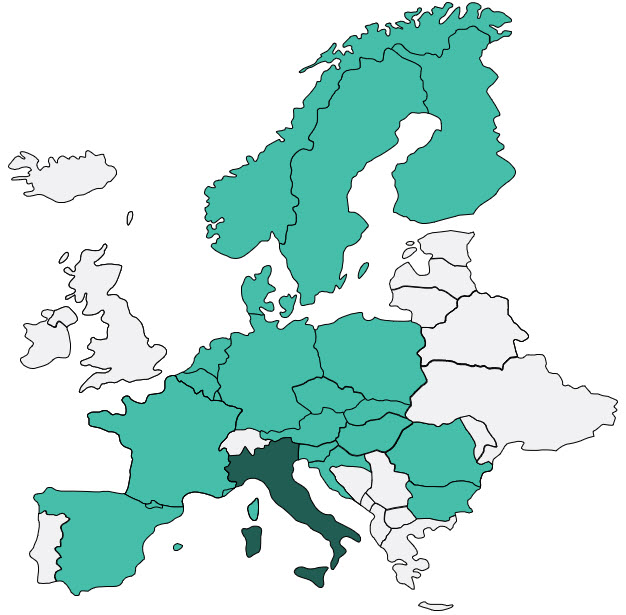

Italy

Italy

Here is the list of Italian banks that you can initiate payments

or retrieve data from using our Open Banking products:

- Credito Cooperative italiano (via Allitude)

- Banca Akros S.p.A

- Banca Aletti

- Banco Cesare Ponti

- Banca Desio

- Banca Euromobiliare

- Banca Fideuram S.p.A.

- Banca Galileo (Inbank)

- Banca Generali

- Banca IMI S.p.A.

- Banca Popolare Di Sondrio

- Banca Sella

- Banco BPM

- Banco di Sardegna

- Banco Poste

- Banco Widiba

- BiBanca

- BNL

- BNL Corporate

- BPER

- CREDEM

- Credit Agricole Cariparma

- Deutsche Bank

- Deutsche Bank - Corporate

- FINECO

- Hello Bank!

- ICCREA

- Iccrea Banca

- ING

- Intesa Sanpaolo S.p.A.

- Isybank S.p.A.

- Intesa Sanpaolo Private Banking S.p.A.

- Mediolanum

- Monte Paschi di Siena

- PostePay

- UniCredit - buddybank

- UniCredit S.p.A

- Revolut

- N26

Enable "on this page" menu on doc section

On

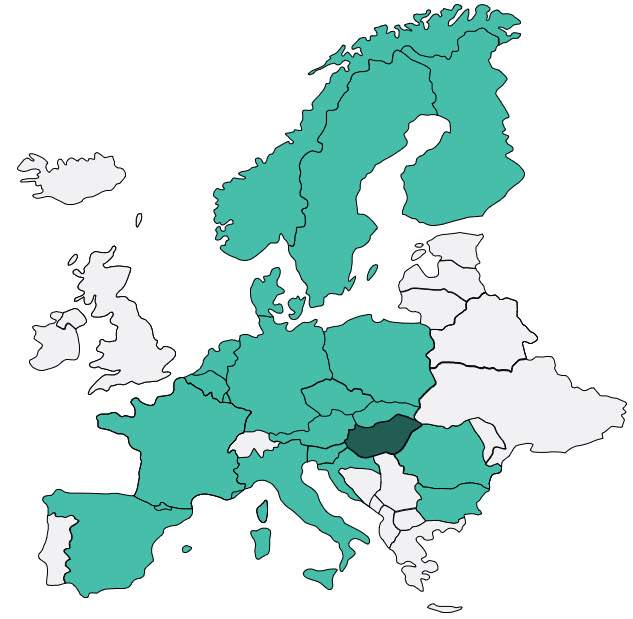

Hungary

Hungary

Here is the list of Hungarian banks that you can initiate payments or

retrieve data from using our Open Banking products:

- Budapest Bank Zrt. (now MKB)

- CIB Bank Zrt.

- Erste Bank Zrt.

- ING Bank Magyarorszagi Fioktelepe

- K&H Bank Zrt.

- MKB Bank Zrt.

- OTP Bank Nyrt.

- Raiffeisen Bank Zrt.

- Revolut

- TakarékBank Zrt. (now MKB)

- UniCredit Bank Hungary Zrt.

Enable "on this page" menu on doc section

On

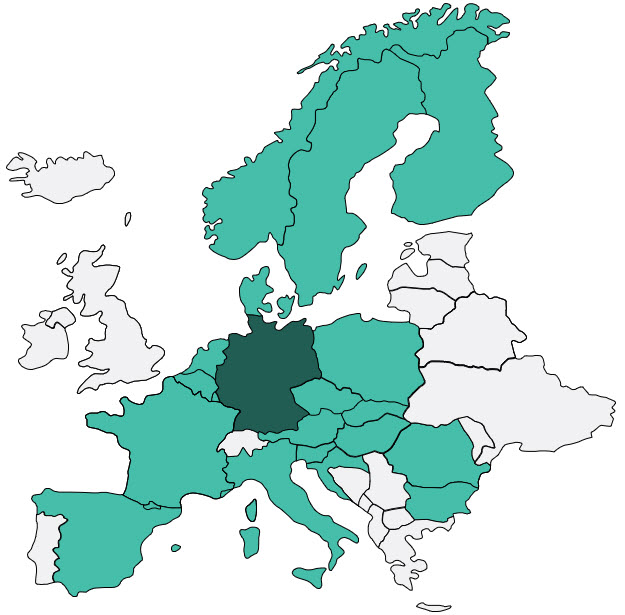

Germany

Germany

Here is the list of German banks that you can initiate payments or

retrieve data from using our Open Banking products:

- Areal Bank AG

- Comdirect

- Commerzbank

- Consorsbank

- Deutsche Bank

- DKB Deutsche Kreditbank AG

- DZ Bank AG

- Hamburg Commercial Bank (HSH Nordbank)

- HSBC Retail Trinkaus & Burkhardt AG

- Hypovereinsbank - HVB Online Banking

- Hypovereinsbank - UC eBanking Global

- Hypovereinsbank - UC eBanking Global - UK Branch

- ING-DiBa

- N26

- Norisbank AG Berlin

- Postbank AG

- Santander Consumer Bank AG

- SEB AG

- Sparda-Bank Augsburg

- Sparda-Bank Baden-Württemberg

- Sparda-Bank Berlin

- Sparda-Bank Hamburg

- Sparda-Bank Hannover

- Sparda-Bank Hessen

- Sparda-Bank München

- Sparda-Bank Nüremberg

- Sparda-Bank Ostbayern

- Sparda-Bank Südwest

- Sparda-Bank West

- Sparkassen-Finanzgruppe

- Targobank

- Volksbanken & Raiffeisenbanken

- Volkswagenbank

Enable "on this page" menu on doc section

On