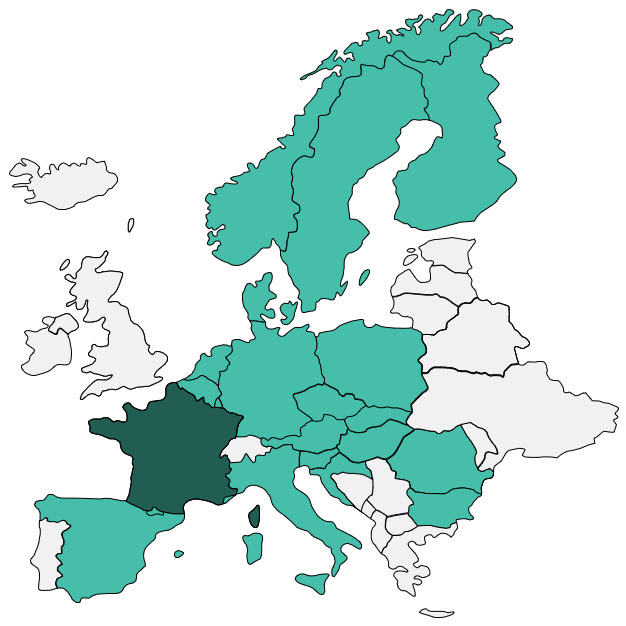

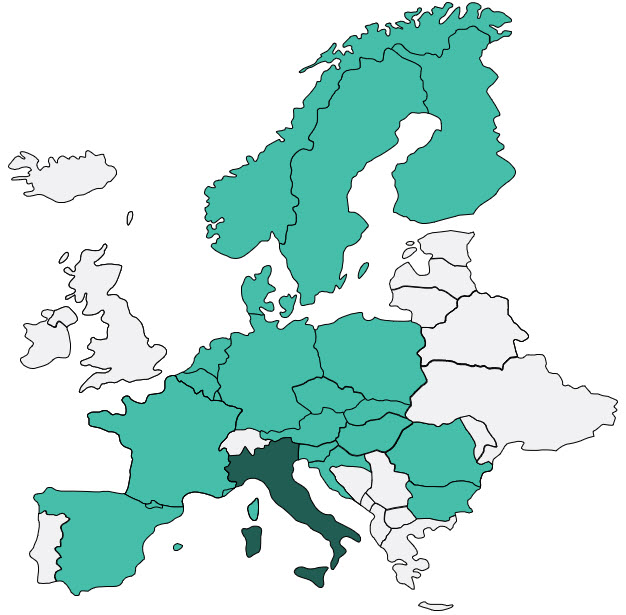

France

Here is the list of French banks that you can initiate payments or

retrieve data from using our Open Banking products:

- Allianz Banque

- Arkéa Banque Entreprises et Institutionnels

- Arkéa Banque Privée

- AXA Banque

- Banque BCP

- Banque Chalus

- Banque Courtois (groupe Crédit du Nord)

- Banque de Savoie

- Banque Kolb (groupe Crédit du Nord)

- Banque Laydernier (groupe Crédit du Nord)

- Banque Nuger (groupe Crédit du Nord)

- Banque Palatine

- Banque Populaire Alsace Lorraine Champagne

- Banque Populaire Aquitaine Centre Atlantique

- Banque Populaire Auvergne Rhône-Alpes

- Banque Populaire Bourgogne Franche-Comté

- Banque Populaire du Nord

- Banque Populaire du Sud

- Banque Populaire Grand Ouest

- Banque Populaire Méditerranée

- Banque Populaire Occitane

- Banque Populaire Rives de Paris

- Banque Populaire Val de France

- Banque Rhône-Alpes (groupe Crédit du Nord)

- Banque Tarneaud (groupe Crédit du Nord)

- BNP Paribas Ma Banque

- Boursorama

- BPCE Natixis

- BRED Banque Populaire

- Caisse d'Épargne

- CIC (Crédit Industriel et Commercial)

- Crédit Agricole

- Crédit Coopératif

- Crédit du Nord (groupe Crédit du Nord)

- Fortuneo

- Hello Bank

- ING France

- La Banque Postale

- LCL (Le Crédit Lyonnais)

- Monabanq

- Natixis

- Société Générale