Internal Kim WS server

Internal Get Bin WS

Internal Authentication KIM WS Admin

Certificate WS Server

Internal Authentication Proxy WS

APM WS Server

Authentication WS Client

Authentication Callback WS Server

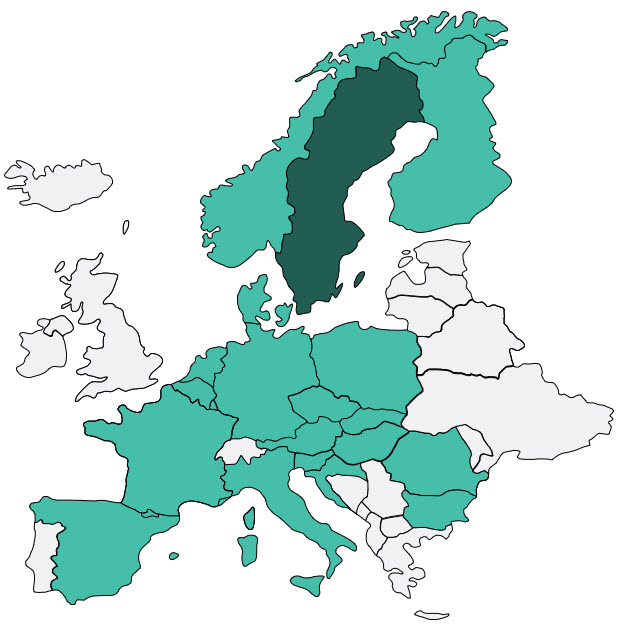

Sweden

Here is the list of banks in Sweden that you can initiate payments or

retrieve data from using our Open Banking products:

- Ålems Sparbank

- Åse Viste Sparbank

- Åtvidabergs Sparbank

- Bank Norwegian AS

- Bergslagens Sparbank AB

- Bjursås Sparbank

- Dalslands Sparbank

- Danske Bank A/S, Danmark, Sverige Filial

- Ekeby Sparbank

- Ekobanken medlemsbank

- Falkenbergs Sparbank

- Fryksdalens sparbank

- Hälsinglands Sparbank

- Häradssparbanken Mönsterås

- Högsby Sparbank

- Ivetofta Sparbank i Bromölla

- JAK Medlemsbank

- Kinda-Ydre Sparbank

- Laholms Sparbank

- Lån & Spar Sverige, bankfilial

- Länsförsäkringar Bank

- Leabank Sverige (formerly BRAbank)

- Lekebergs Sparbank

- Leksands Sparbank

- Lönneberga-Tuna-Vena Sparbank

- Markaryds sparbank

- Mjöbäcks Sparbank

- Nordea Bank Abp, filial i Sverige

- Norrbärke Sparbank

- Orusts Sparbank

- Revolut

- Roslagens Sparbank

- Sala Sparbank

- Sidensjö sparbank

- Skandiabanken Aktiebolag (publ)

- Skandinaviska Enskilda Banken AB

- Skurups Sparbank

- Snapphanebygdens Sparbank

- Södra Dalarnas Sparbank

- Södra Hestra Sparbank

- Sölvesborg-Mjällby Sparbank

- Sörmlands Sparbank

- Sparbanken Alingsås AB

- Sparbanken Boken

- Sparbanken Eken AB

- Sparbanken Göinge AB

- Sparbanken Gotland

- Sparbanken i Enköping

- Sparbanken i Karlshamn

- Sparbanken Lidköping AB

- Sparbanken Nord

- Sparbanken Rekarne AB

- Sparbanken Sjuhärad AB (publ)

- Sparbanken Skåne AB (publ)

- Sparbanken Skaraborg AB (publ)

- Sparbanken Syd

- Sparbanken Tanum

- Sparbanken Tranemo

- Sparbanken Västra Mälardalen

- Sparbankerna

- Svenska Handelsbanken AB

- Swedbank AB

- Tidaholms Sparbank

- Tjörns Sparbank

- Tjustbygdens Sparbank Bankaktiebolag

- Ulricehamns Sparbank

- Vadstena Sparbank

- Valdemarsviks Sparbank

- Varbergs Sparbank AB (publ)

- Vimmerby Sparbank AB

- Virserums Sparbank

- Westra Wermlands Sparbank

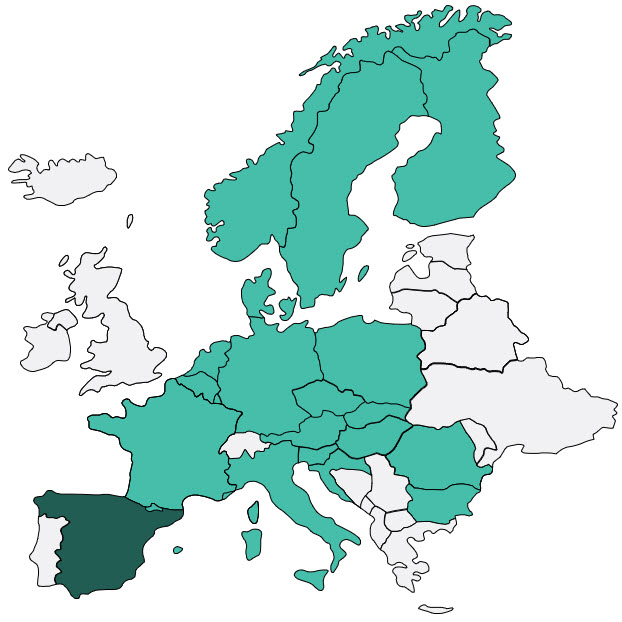

Spain

Here is the list of banks in Spain that you can initiate payments

or retrieve data from using our Open Banking products:

- Andbank

- Arquia Banca

- Banca March

- Banca Mediolanum

- Banco Alcalá

- Banco de Sabadell

- Banco Inversis

- Banco Pichincha

- Banco Santander

- Bankinter

- Bankoa

- BFF

- Caixa Popular

- Caixa Rural Benicarlo

- Caixa Rural Galega

- CaixaBank (including Bankia)

- Caja Rural Adamuz

- Caja Rural Albal

- Caja Rural Algemesi

- Caja Rural Aragon (Bantierra)

- Caja Rural Asturias

- Caja Rural Baena

- Caja Rural Canete De Las Torres

- Caja Rural Casas Ibanez

- Caja Rural Central (Orihuela)

- Caja Rural Del Sur

- Caja Rural El Salvador Vinaroz

- Caja Rural Extremadura

- Caja Rural Fuentealamo

- Caja Rural Gijon

- Caja Rural Granada

- Caja Rural Jaen

- Caja Rural Lalcudia

- Caja Rural Navarra

- Caja Rural Nueva Carteya

- Caja Rural Onda

- Caja Rural Salamanca

- Caja Rural San Isidro Les Coves Vinroma

- Caja Rural San Isidro Vall Duxo

- Caja Rural San Jose Alcora

- Caja Rural San Jose De Almassora

- Caja Rural Soria

- Caja Rural Teruel

- Caja Rural Utrera

- Caja Rural Villamalea

- Caja Rural Zamora

- Caja Sur

- Cajasiete

- Cajaviva

- Colonya Caixa Pollenca

- Eurocaja Rural

- Evobanco

- Fiare Banca

- Globalcaja

- Grupo Cooperativo Cajamar

- Ibercaja

- KutxaBank

- Laboral Kutxa

- N26

- OpenBank

- Renta4Banco

- Revolut

- Ruralnostra

- Self Bank

- Unicaja Banco

- Wizink