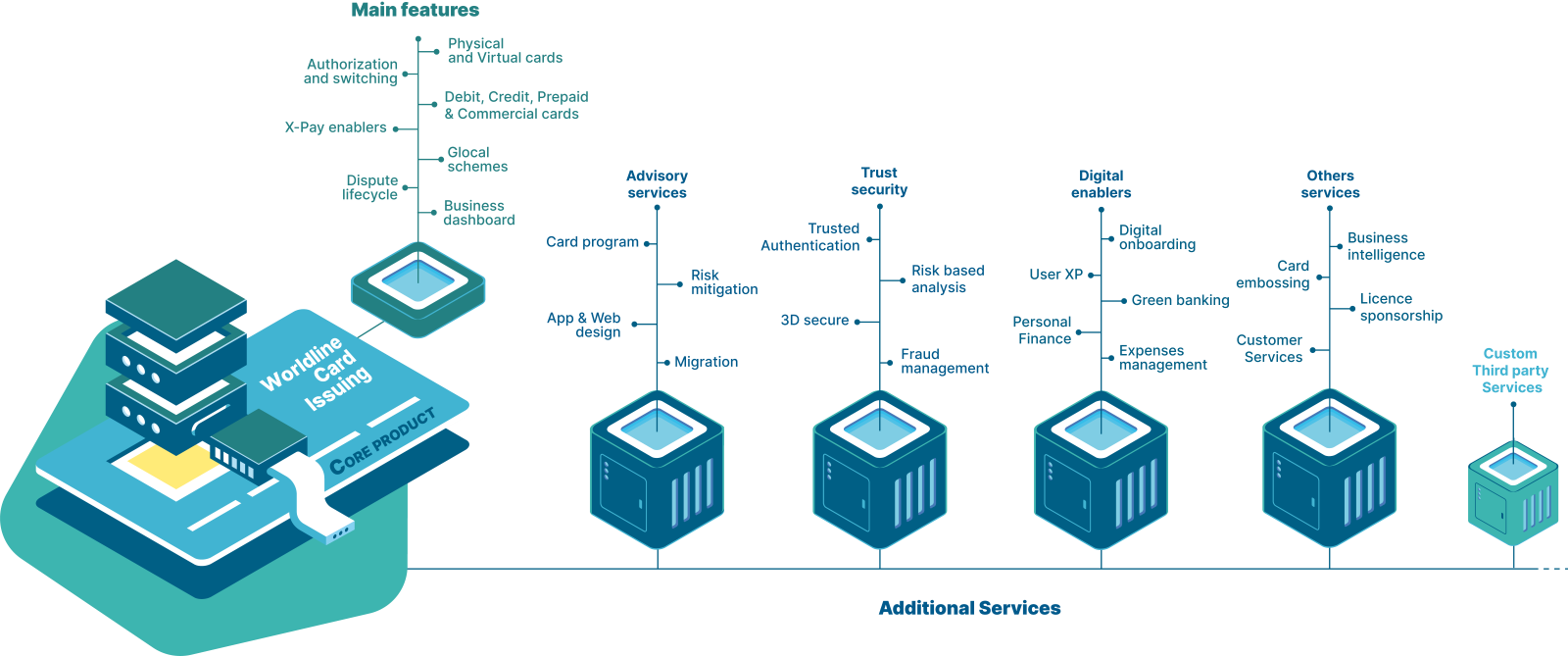

Worldline Card Issuing in a Nutshell

A quick tour of Worldline Card Issuing

Worldline Card Issuing includes all the core features enabling to instantly issue cards and process payments :

-

Issue any type of card : debit, credit, pre-paid whatever its form physical/virtual,

-

Authorize and process transaction efficiently thanks to a proven technology already processing more than 10 billions of transactions a year

-

Launch a new product on international schemes but also on local ones, Wordline Card Issuing being GLOCAL !

-

Embrace the wallet revolution by having the possibility to tokenize you card portfolio and make it compatible with mobile wallet providers

-

Manage disputes and initiate chargeback to a merchant in line with the schemes’ rules and regulation.

Creating and managing your cards portfolio using Worldline Card Issuing will follow 4 main steps that can be easily done through our powerfull REST/json APIs.