ob-p-a2a

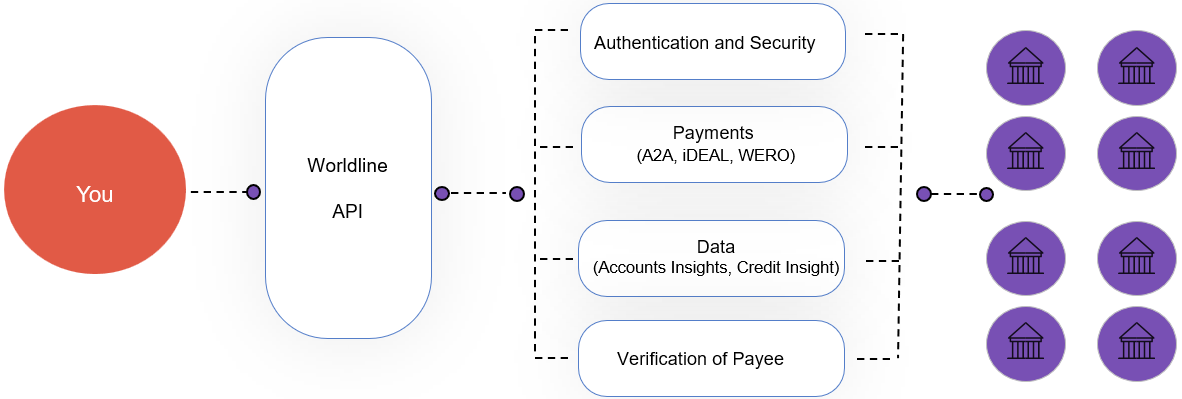

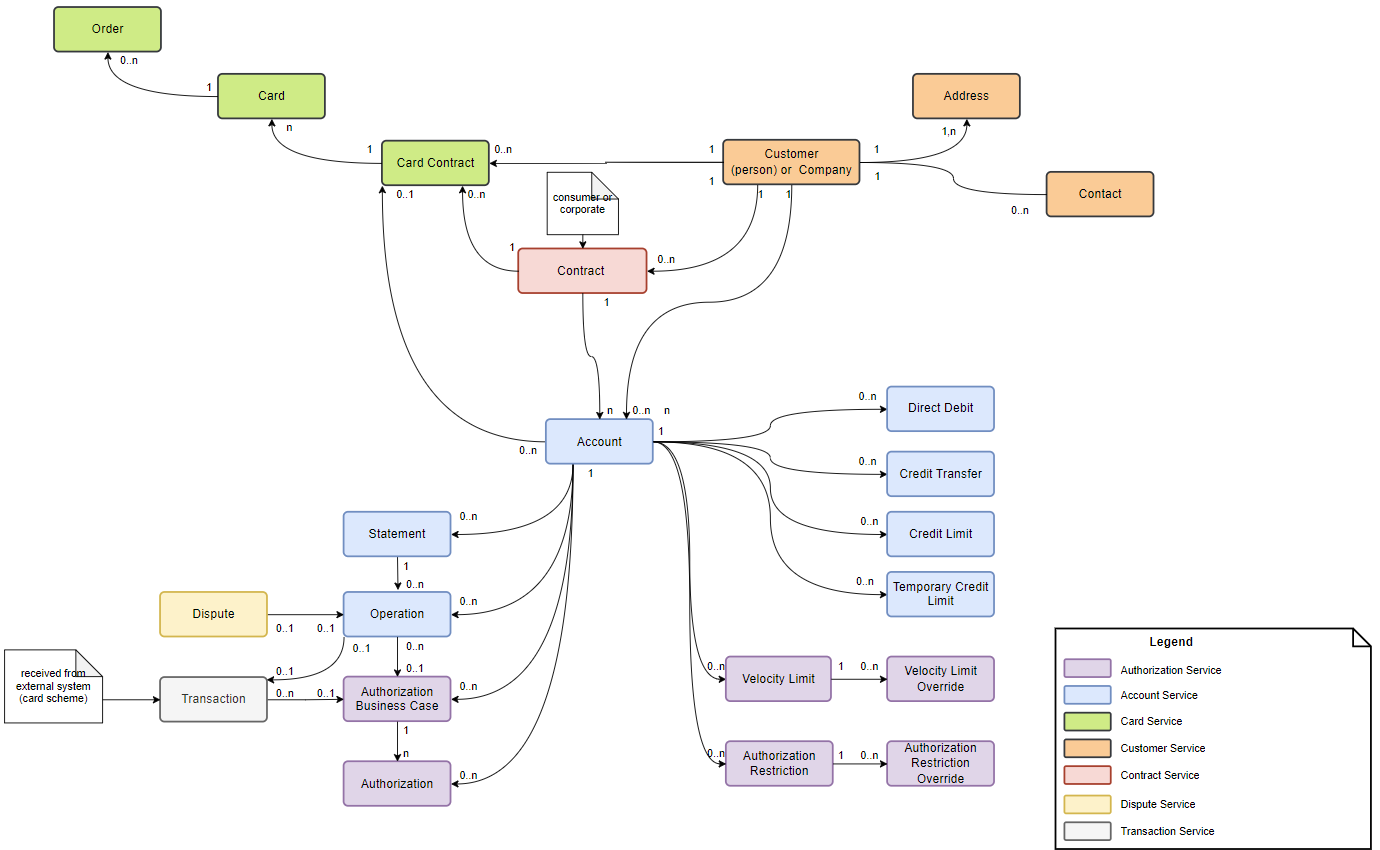

Payment processing consists of several main steps, visible in the diagram and explained in dedicated chapters:

-

Payment Preparation

-

Payment Initiation

-

Payment Authorisation

-

Payment Execution

Worldline prepared a set of functions supporting these steps (the white boxes in the diagram). Each of those functions have a page with more explanation. You can choose how to integrate:

-

Using Worldline Open Banking functions directly. This allows you to control the user experience, but will require more integration effort due to various combinations of payment flows.

-

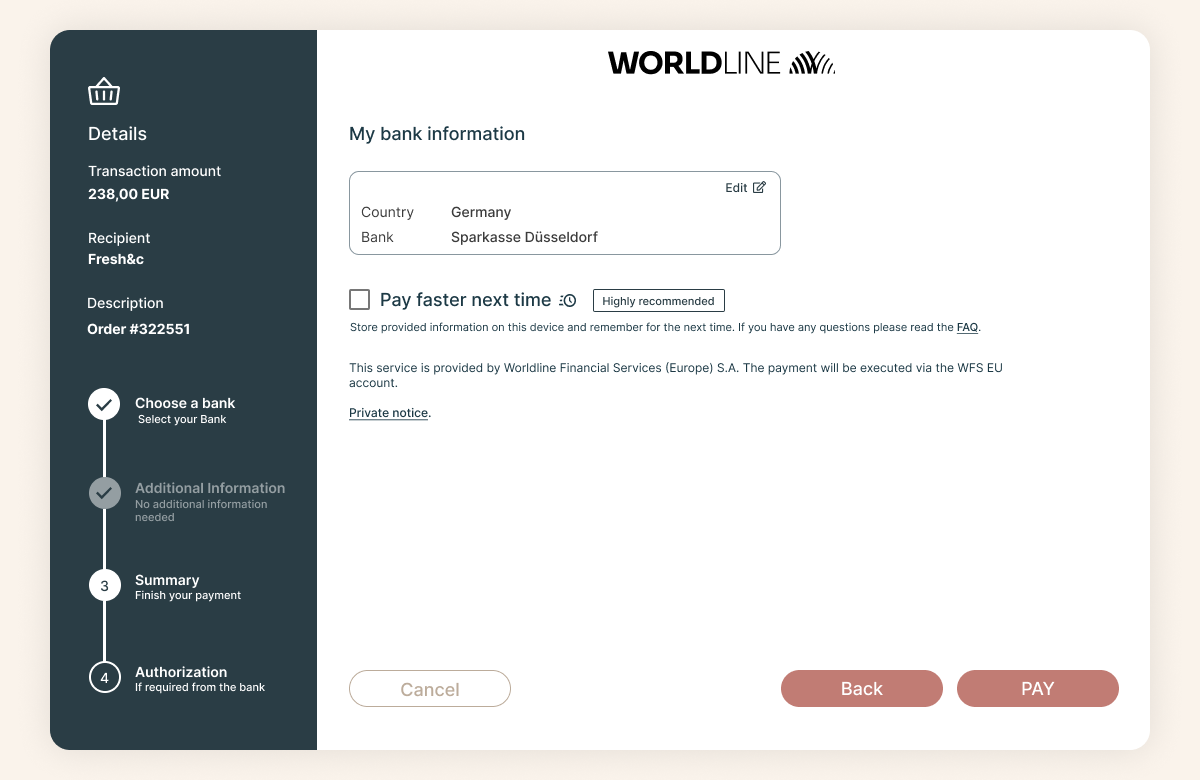

Using ready-to-go components (Bank Selection Interface and Push Notification). This will provide you with a streamlined integration due to a set of (white labeled) screens which support Bank selection and guides users through the payment steps and push notifications that you will receive whenever payment status changes.

Both integration options can also be combined.

Once you finished your implementation we recommend to go through the list of suggested testing scenarios