Buy Now Pay Later

Buy Now Pay Later

Buy now, pay later is a payment method that allows consumers to buy a product immediately and pay later. This payment method is gaining popularity around the world, especially among younger consumers.

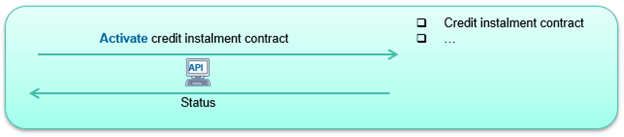

Buy Now Pay Later works like this: Consumers make purchases online or in-store, then select the Buy Now Pay Later payment method. The consumer can then select a later payment date that is convenient to him. Depending on the terms of the contract, fees or interest may apply to this payment method.

Buy now, pay later offers consumers several benefits, including the ability to defer payments to a later date, which can help during temporary financial hardship. Additionally, consumers can better manage their budgets by spreading payments over multiple months.