These pages describe the components from the Open Banking API version 3 which are used to initiate a WERO payment. WERO is an European payment system created by the European Payments Initiative (EPI). It helps facilitate quick, secure, and straightforward bank-to-bank (A2A) transactions for individuals and companies.

If you would like to learn about the various ways WERO can be used, we recommend visiting this very informative interactive website: Wero - Digital Payment Wallet. The page is published by EPI - owner of the Wero brand - and presents practical use cases for individuals and businesses, offers interactive demos to explore how it works, and provides step-by-step guidance to get started, including onboarding paths and deployment timelines, plus essential privacy and security notes.

Here you learn, how Worldline simplifies the WERO flow - one single API, which is used for nearly all payment means, does all needed steps (consent, authorization, capture) in one single call for you.

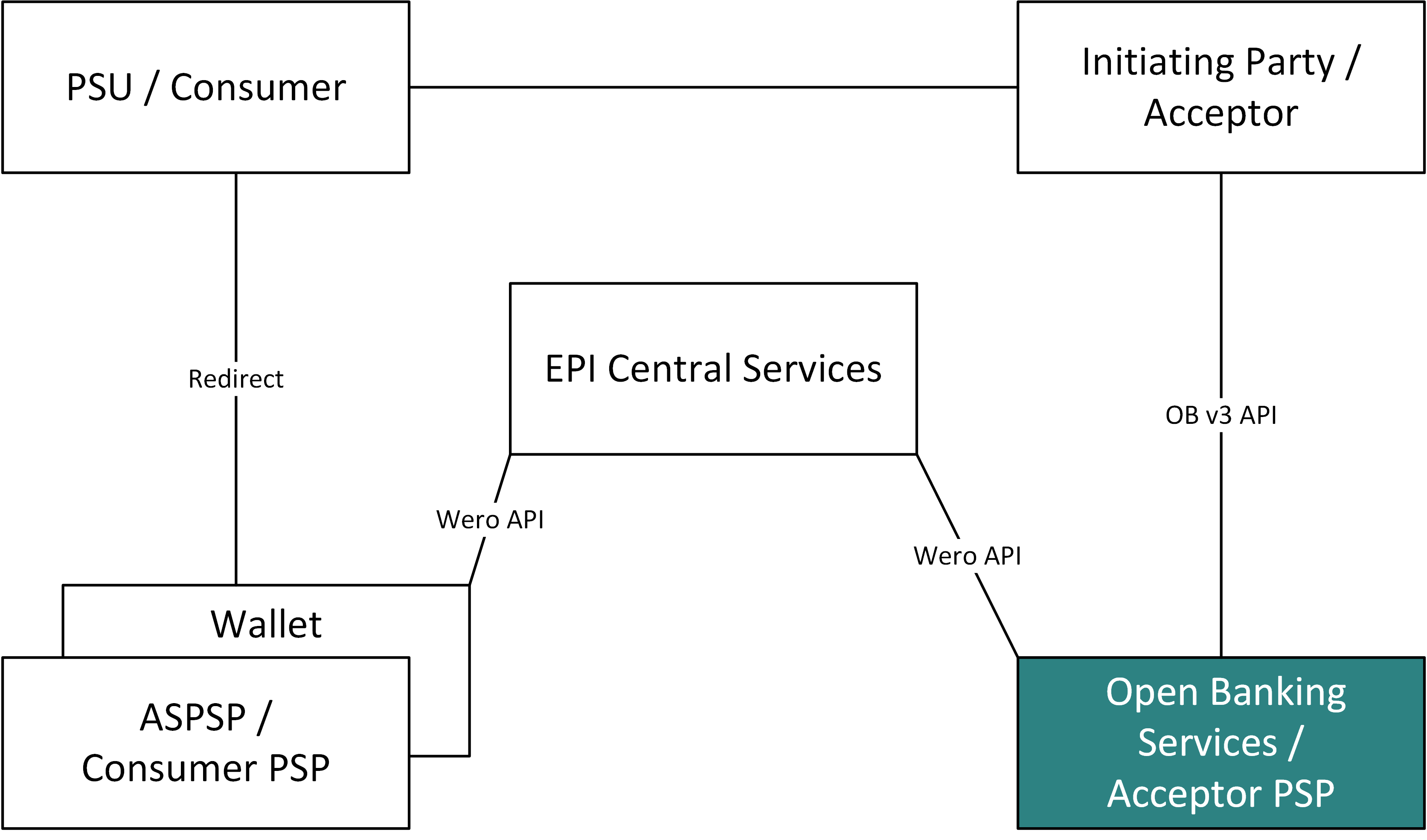

Ecosystem overview

The Open Banking Services, marked in green, is provided by Worldline. The Consumer interacts with the Acceptor to start a payment. He is redirected to their Wallet to authenticate/authorize. The Wallet communicates with the EPI Central Services via the Wero API. The Acceptor uses the OB v3 API to talk to Open Banking Services / Acceptor PSP. The EPI Central Services coordinates between the Wallet and the Open Banking Services / Acceptor PSP using the Wero API.

With the Open Banking Service Worldline is a Technical Solution Provider (TSP) within the Wero scheme, providing it's services to the Acceptor PSP. Thereby enabling the Acceptor PSP and it's Acceptors (Merchants) to provide the Wero payment product.

Terminology

The terminology used in these pages and the mapping to their Payment Service Directive 2 equivalents.

| Term | Equivalent PSD2 term | Description |

|---|---|---|

| Consumer PSP | ASPSP | The Account Servicing Payment Service Provider (ASPSP); the Issuer bank which is responsible for the Consumer's account. |

| EPI | European payments initiative (EPI Company | Home), owner of both the iDEAL and Wero brand. EPI provides an EPI Central Services hub which connects to the participants of Wero. | |

| Acceptor | Initiating Party | The Acceptor contracts the TSP for the WERO service, and sends a WERO payment request to the Open Banking Service on behalf of a Consumer. |

| Consumer | PSU | The Consumer is account holder by one or more Consumer PSP's and allows other parties to initiate payment requests. |

| SCT Inst | The SEPA Instant Credit Transfer is the underlying instant-settlement infrastructure that powers WERO’s real-time payments across Europe. Payments are settled in seconds, available 24/7/365, for transfers between participating banks across the SEPA region. | |

| Technical Service Provider (TSP) | TPP | The Technical Service Provider (TSP) can be contracted by acceptor PSPs or consumer PSPs and be authorised to participate in the payments flow. The 'Open Banking Service' refers to the Worldline provided software, which handles the routing of the WERO payments for the Acceptor PSP. |

| Wallet | The Wero wallet can be a standalone app or can be access through the Consumer PSP's bank app. | |

| WERO | We - Euro, is the new pan European payment system created by the European Payments Initiative (EPI), which will replace iDEAL and other national payment products. It is designed to enable fast, secure payments for individuals and businesses, can be accessed via bank apps or a dedicated mobile app, and aims to become Europe’s standard for digital payments. | |

| EPI Central Services | The EPI Central Services operates as the centralized control point for WERO payments, ensuring end-to-end coordination across participants. |

Open Banking API features for WERO payments

WERO will support different payments plans, at the moment the following is supported:

- Single Immediate Payment: For a successful single, immediate payment, the Consumer is strongly authenticated and consents to one payment. The payment is immediately authorized and captured. The money is settled immediately using the SEPA SCT Inst rail.