This page describes the transaction flows for WERO payments, designed to provide a seamless payment experience whether accessed via the WERO mobile app or through bank-integrated solutions.

Which Wero Payments are supported?

- Single Immediate Payments

More Wero payment plans will be added in the future.

In the paragraphs below you can find a brief explanation of the payment flows from the Consumer perspective and from the Acceptor's (technical) perspective.

WERO flow from the Consumer perspective

What is the difference between an e-commerce and m-commerce flow?

The flows differ in how the redirection between the online shop and the Wero digital wallet happens:

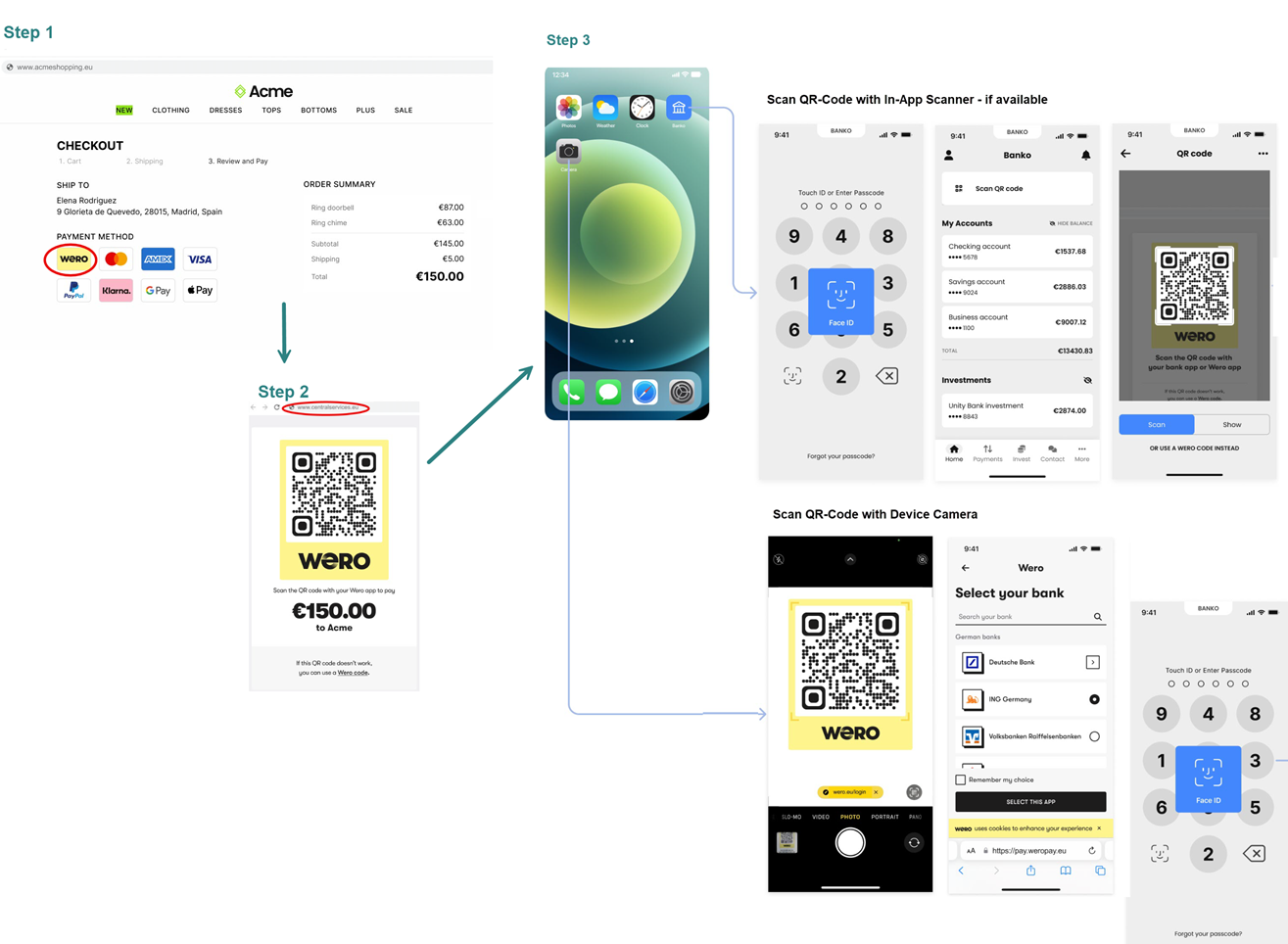

- in the e-commerce flow (web storefront checkout (desktop or mobile web), a Wero landing page is displayed with a QR code for linking the online shop to the Wero digital wallet.

- in the m-commerce flow (shop and pay in smartphone), the wallet is launched automatically after tapping the "pay with Wero" button, and no QR code is needed.

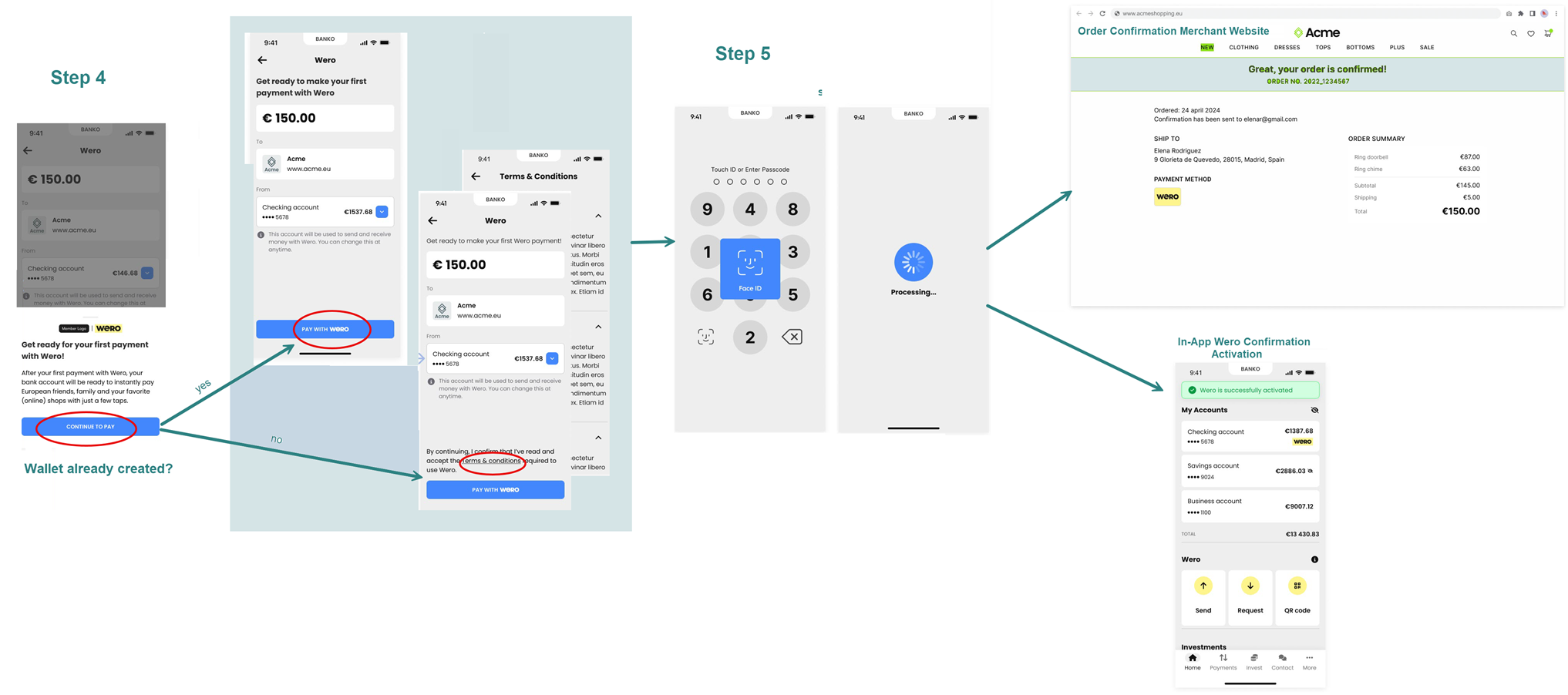

The actual WERO transaction flow that the Consumer follows depends on where the payment authorization takes place (in a standalone Wero wallet or in the Consumer PSP's app) And if a Consumer is already registered for WERO.

Below you'll find an example screen flow of the e-commerce flow for a Wero single immediate payment:

The Consumer flow does not impact the integration between the Acceptor and the Worldline Open Banking Solution.

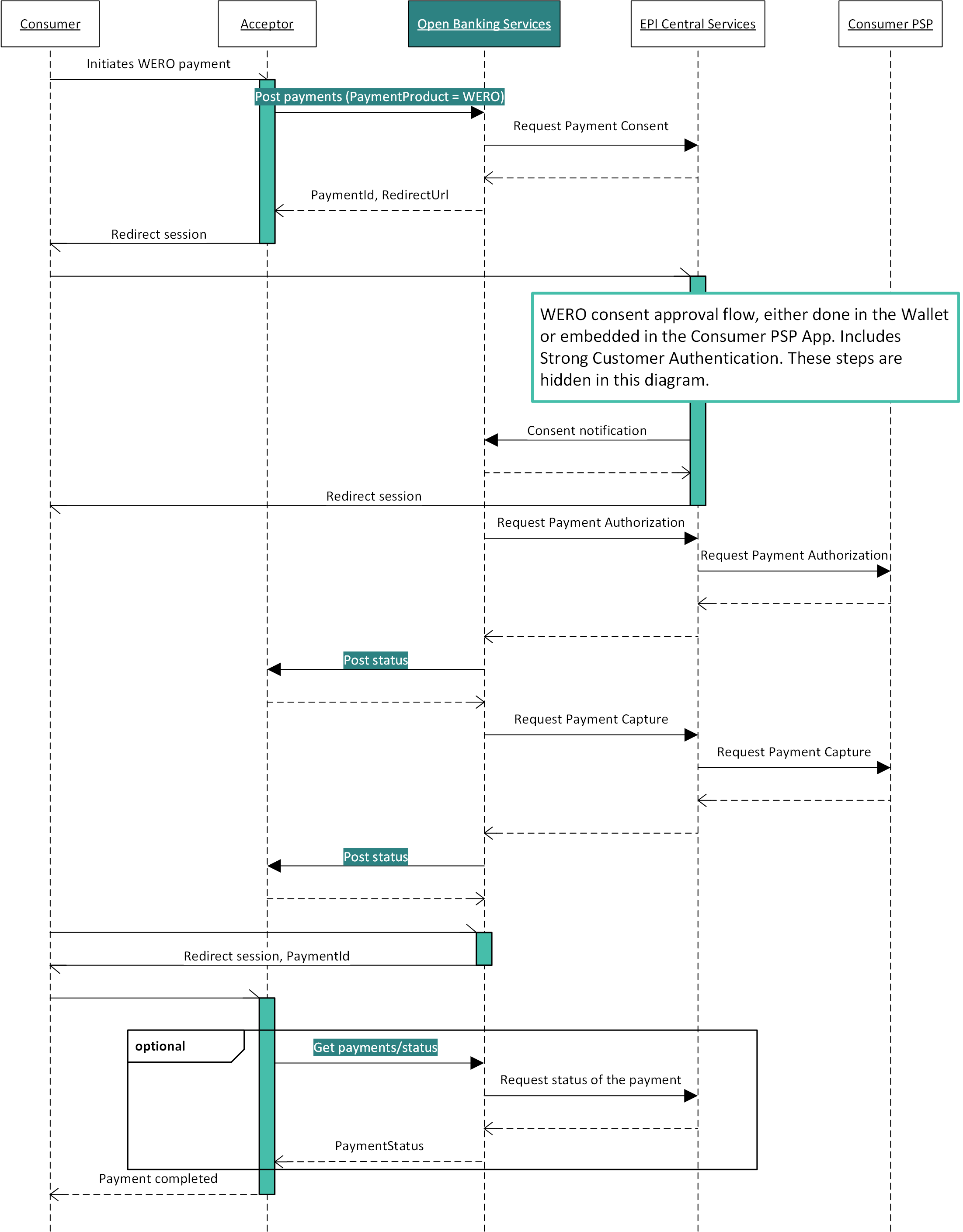

Wero flow from the Acceptor perspective (technical)

WERO Single Immediate Payment

In the diagrams below, the sequence of requests is shown to initiate a Wero Single immediate payment. The vertical green bars indicate which party is responsible for the session of the Consumer. If a party has the session, a screen can be displayed. Notice that in the WERO flow, the Acceptor can receive a notification when the authorization of the payment is finished on the Consumer PSP side. To receive this notification, the Acceptor should implement the Post status API, so that this can be called by the Open Banking Service. The Acceptor also has the option to request the status by calling the Get /payments/status API of the Open Banking Service.