The Bank Selection Interface includes customizable screens for payers to select their bank and complete any necessary authorization steps. Simply set the field UseAuthorisationLandingPages= true in the Payment Initiation Request to use this feature. It makes integration easier and streamlines the payment process. These are the typical steps to carry out a payment:

Typical Steps

Customization

Example scenarios

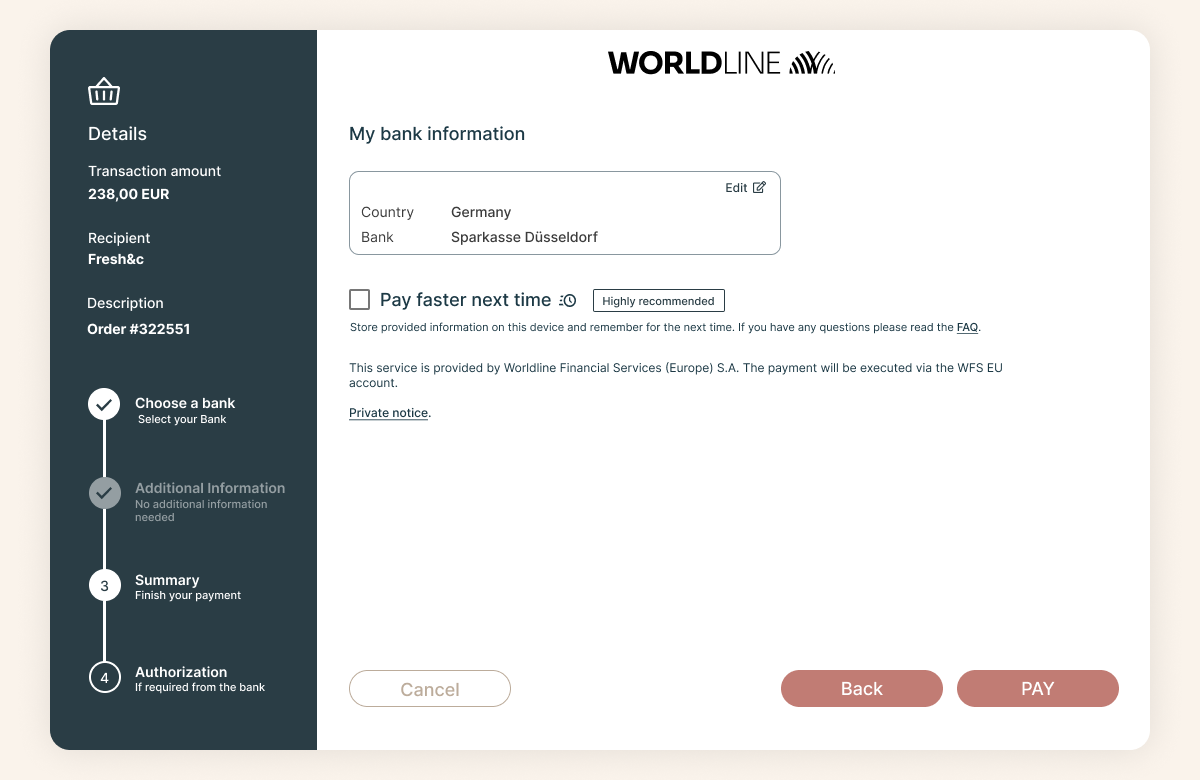

Below you can interact with a few example scenarios. The interactivity is limited, but it gives a good impression of the screen flow a payer will face when using the Bank Selection Interface (a live demo is also available here). It showcases the difference between the desktop and mobile user interface and the difference in flow when the payment preferences are saved (the payer check-marked 'Pay faster next time'), in a previous payment.

Implementation

To initiate a payment using the Bank Selection Interface the following functions should be implemented:

The diagram on the right shows the typical payment flow using Bank Selection Interface. You can click on the image to enlarge it.

|  |

Example: Post payments API request which redirects to Bank Selection Interface

curl --location --request POST 'https://xs2a-int.awltest.de/xs2a/routingservice/services/ob/pis/v3/payments' \

--header 'X-Request-ID: 6e16f87f-08b1-460e-972d-21b824f07113' \

--header 'Content-Type: application/json' \

--header 'Authorization: Bearer ### Fill token here ###' \

--header 'MessageId: d1efddaf-ea94-4c37-9b57-18640bd422a4' \

--header 'MessageCreateDateTime: 2020-11-13T03:49:45.784Z' \

--header 'UseAuthorisationLandingPages: true' \

--data-raw '{

"PaymentProduct": [

"PSD2-SCT"

],

"CommonPaymentData": {

"EndToEndId": "EndtoEndId",

"InitiatingPartyReferenceId": "### unique value ###",

"Amount": {

"Amount": "238.00",

"Currency": "EUR"

},

"RemittanceInformation": "Order #322551"

}

}'